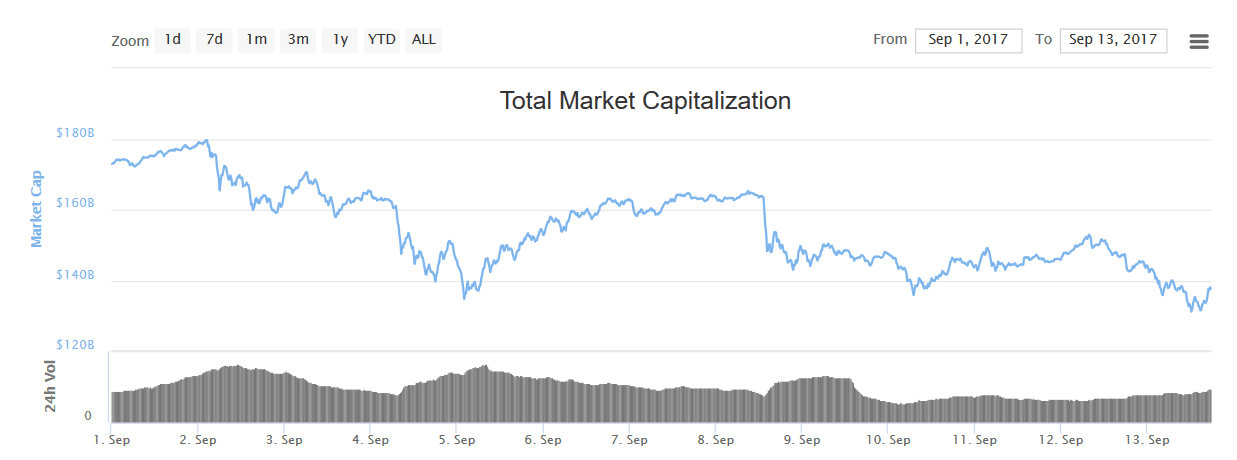

September is vooralsnog geen goede maand voor de cryptocurrencies. Sinds het verbod op ICO’s in China is de totale crypto market cap gedaald van 180 miljard naar 135 miljard dollar. Een daling van zo’n 25% in twee weken tijd. Zie hieronder de grafiek van de afgelopen weken.

China bepalend voor koersverloop

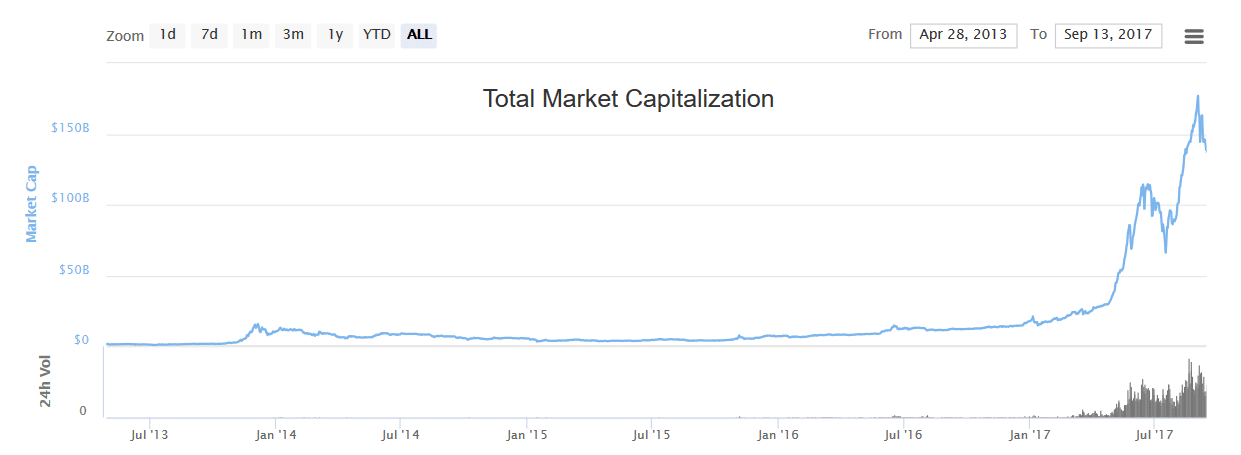

De prijs van bitcoin noteert momenteel weer onder de $4000,- per stuk. Dat is toch een slordige 1000 dollar minder dan het hoogste punt van 5000 dollar dat begin september werd neergezet. Nu China heeft aangekondigd dat, naast een verbod op Initial Coin Offerings, waarschijnlijk ook bitcoin- en cryptobeurzen de deuren moeten sluiten is de tendens momenteel zeer negatief. Hieronder overigens nog wel even de grafiek van de crypto market cap op een iets langere termijn, zodat de recente forse daling in perspectief kan worden gezien.

JP Morgan over cryptocurrencies

De Amerikaanse grootbank JP MOrgan heeft een statement gepubliceerd over cryptocurrencies. Ze gaan in op wat het nu precies is. Een valuta? Een grondstof? Kunnen crypto’s failliet gaan? Tevens vragen ze zich af of de cryptocurrency markt nu een piramidespel is. Maarja, what’s new met de conventionele gevestigde grootbanken. Hieronder het hele stuk van JP Morgan

Are Cryptocurrencies a New Asset Class or a Pyramid Scheme?

What are Cryptocurrencies? Recently, a number of sell-side market strategies and researchers opined on the merits of investing in Bitcoin and other cryptocurrencies. Some went as far as introducing price targets and making relative value calls on cryptocurrencies vs. other asset classes. The number of cryptocurrencies now existing is in the hundreds (~$150bn total assets), and there are dozens of cryptocurrency hedge funds launched (e.g. here). Developments arounds distributed ledgers and the concept of digital currencies are fascinating from a technological point of view. It is likely that some of these technologies will become very valuable. The supply of cryptocurrencies is not controlled by central banks, and they can be used to avoid capital controls, enable tax evasion, or fund transactions on the dark web. As such, cryptocurrencies may ideologically appeal to proponents of small government (however, a paradox is that distributed ledger technology in principle enables unprecedented centralized access to the digital records of any and every transaction).

In this note, we want to highlight the risks of cryptocurrencies. Cryptocurrencies cannot be reliably valued and they have significant ‘tail risk’ that could come in the form of a regulatory ban. Moreover, the whole cryptocurrency market exhibit some parallels to fraudulent Pyramid schemes.

Are they Currencies? Currently, there are few legitimate reasons to use cryptocurrencies apart from speculation (e.g. any transactions can be done electronically in country currencies such as USD, EUR, etc.). The claim that cryptocurrencies have lower transaction costs is inaccurate as an asset’s transaction cost is almost always driven by its volatility rather than processing fees (e.g. bitcoin volatility is ~100%, or ~15 times the average currency volatility). Valuing cryptocurrencies as traditional currency is not possible as there are no underlying ‘economy’ to assess supply/demand for its goods and services, there is no fundamentally driven inflation, there are no ‘rate differentials’, etc. Perhaps more importantly, there is no organized power behind this currency to e.g. ensure its long term viability, secure trade, enforce its convertibility into other goods and services, or provide investor fraud protection.

Are they Commodities? Of course, having a government behind a currency is not a guarantor for its survival. In fact, on a long enough timeline, all currencies that were not made of a valued commodity such as gold or possessed exceptional artistic value and rarity became worthless. Should one look at cryptocurrencies as an alternative to Gold rather than country backed currencies? While there is no government to back up either gold or cryptocurrencies, gold has a track record of outliving governments and being use as a store of value going back to the beginning of civilization (at least ~7,000 years). Unlike gold, cryptocurrencies are not engrained in human psychology and backed up by the longest possible backtest. The claim of scarcity of cryptocurrencies via specific code implementation that limits their production is bogus as well. There is no scarcity as virtually anyone can create a new cryptocurrency, and existing algorithms can be modified (e.g. hard forks) to increase the amount of cryptocurrencies.

Can they ‘Default’? If the use of cryptocurrencies were to increase to an extent that they start competing with traditional ‘country’ currencies (e.g. start interfering with the ability of central banks to control money supply, governments to collect taxes, impose sanctions or capital controls, etc.) they would be quickly regulated or outlawed. While similar attempts were made historically on the use of precious metals, cryptocurrencies don’t have multi-millennial track record and place in human history to ensure survival. Even if the cryptocurrencies don’t threaten governments’ primacy on monetary issues, their use may be irritable enough (e.g. avoiding capital controls, evading taxes, dark web, etc.) to prompt a government crackdown. We are already seeing this with recent developments from China and this trend is more likely to continue.

Are they Pyramid Schemes? another worrying aspect of cryptocurrencies are some parallels to fraudulent pyramid schemes. Initiator of a pyramid scheme often ensures ownership of a disproportionally large share of future profits. For instance, in the case of bitcoin, it is believed that an unknown person (or persons) known as ‘Satoshi Nakamoto’, before disappearing, mined the first 1-2M coins or ~10% of the coins that will ever exist ($4-8bn USD current value). While initial mining requires a negligible effort, the benefits for subsequent participants start diminishing. Mining becomes progressively more difficult, and eventually unprofitable, marking the likely end of a scheme. A way around this in Pyramid schemes is to bypass the original chain and start a new one of your own. The cryptocurrency analogy would be to start a new coin if it is more profitable than mining the existing one. This can work as long as there are enough willing and uninformed buyers.

Reactie #Mcafee op Jamie Dimon. #bitcoin https://t.co/u05ntrHJa1

— Biflatie.nl (@Biflatie) 14 september 2017

Best dating site https://goo.gl/wVmrWT

Het begon met een grap, pas nadien werd het gekaapt door de menselijke geldgekte. Misschien moeten we nog leren wat biflatie betekent? But never mind. 🙂

klassiek verhaal van een hype, nu kleine opleving dan verder omlaag met de crypto,s,bomen groeien nooit tot de hemel, wel leuk pyramide spel

Het begon niet met een grap , wat een kolder.Blockchain technologie is de meest secure spotgoedkope transfer van geld tot documenten zonder tussenkomst van banksters en overheden . Dat muntje erbij is een noodzakelijkheid om de geringe fee voor het minen te betalen .Crimineel dimon gaf gewoon een trap naar concurrerende banken , zo is Bnp paribas en Accenture al bezig blockchain te implementeren ( Nxt/ ardor/ignis ) om niet achter te blijven bij de consumenten.De banksters hebben het al verloren van de blockchain, goed voor de consument.Bijvoorbeeld Maersk is ook al hard bezig het te implementeren en zo kan ik nog wel een uurtje doorgaan.De eerste online site werd ook als een grap gezien , do you remember?

We kunnen maar best niet over biflatie beginnen of de wereld wordt helemaal gek, ben er daarom zeker van dat het nog uren kan doorgaan. Ecco homo, straks gaan we de pensioenen betalen met peeschijven, zij het met een 3D-printer gedrukt. Is er nog wel goud genoeg om al deze absurditeiten te dekken?

Er zijn al meer dan 1.000 tokens/munten. Een zeer groot gedeelte van deze munten zullen het niet halen. Recent heeft China op de rem getrapt, ICO’s zijn verboden in China. Op YouTube heeft een blogger aangegeven dat China van plan is om de handel in cryptimunten in zijn geheel te verbieden. Dit heeft implicaties omdat de grootste serverbedrijven in China staan die altcoins ondersteunen. Vallen deze weg, heeft dat dramatische gevolgen voor de verwerkingscapaciteit van alle coins.

Volgens deze bloggers is de prijs van bitcoin binnen het darkweb zeer sterk aan het stijgen. Mocht dit waar zijn, betekent dit dat de burgers hun overheid en dus de munt wantrouwen.

De Chinese economie wordt zwaar ondersteunt door geleend geld onder druk van de Chinese overheid. De komende maanden worden spannend.

Niet helemaal waar.De cryptominers van bitcoin zitten voor het grootste gedeelte in China, waarom?… omdat de stroom daar goedkoop is.Die gaan gewoon naar een volgend land, Siberië, Mongolië bijvoorbeeld, de eerste zijn al onderweg.China wordt van deze typische Mao rel er zelf het slechtst van.Die cryptoexchanges verhuizen gewoon , dat kan juist met cryptocoins zo makkelijk ,NIET met dollars en euro’s.By the way , Nxt, ardor Ignis coins en nog een paar altcoins gebruiken bijna geen stroom (Proof of stake protocol).

Ik heb er niet bij stil gestaan, dat je gewoon nieuwe serverbedrijven kunt opzetten buiten China. Gisteren heb ik een vlog gezien, dat er genoeg verwerkingscapaciteit is om de crypyomarkt in de lucht te houden.

Als je de ontwikkeling van de koersen van de laatste dagen ziet, zie je toch een bepaalde terughoudendheid van kopers/verkopers. De vraag is hoe andere landen gaan reageren op het besluit van china. Ik heb ook begrepen dat ook de exchanges gesloten gaan worden.

China schiet in z’n eigen voet.De enige reden is macht over een gecentraliseerde blockchain( een eigen coin bijvoorbeeld) , maar dat lukt helemaal nooit want blockchain kan alleen maar bestaan dankzij geDEcentraliseerde ledgers.Alleen gedecentraliseerde anonieme computers kunnen de blockchain onderhouden.Dat is de kracht van blockchain, een onomkeerbaar veilig en secuur protocol .Een contract hoeft bij wijze van spreken niet meer langs een notaris ter ondertekening.

De database met de gegevens over alle transacties worden decentraal vastgelegd. Iedere gebruiker heeft een kopie van de database. Het programma zorgt er voor dat alle transacties worden gecontroleerd en goedgekeurd.

Als China controle wilt over de blockchain zal dit niet gaan lukken. Dus, zowel iedere monopolist dat doet, wordt het verboden.

Het was slechts een kwestie van tijd, wanneer het ging gebeuren. Stel, dat op 1-1-2018, iedereen overgaat op bijvoorbeeld bitcoin of meerdere coins. Wat denk je wat er gaat gebeuren met het fiat geld? Die wordt waardeloos. Maar, het zal een drama worden voor de mensen die afhankelijk zijn van de overheid; bestuurders, ambtenaren, uitkeringsgerechtigden. Ik denk dat de belastinginkomsten dramatisch gaan zakken, en daarmee gaat het hele verzorgingsstelsel op de helling.

Er zijn genoeg mensen die vinden dat de belastingdruk te hoog is, maar niet beseffen, dat deze hoog is, door de hoge uitgaven van de overheid als gevolg van publieke goederen en diensten. De massa denkt dat het laatste namelijk gratis is.

Op basis hiervan denk ik, dat veel overheden alsnog het voorbeeld van China gaan volgen. De vraag, in welke mate?!

Zelfs de Rotterdamse haven gaat al over op blockchain , diverse banken en verzekeraars zijn al bezig met tests en implementatie.Een website bestond 25 jaar geleden ook nog niet.China is een 5000 jaar oude dynastie , dat verandert nooit.Ik wil maar zeggen dat een innovatie weliswaar door monopolisten wordt gefrustreerd maar uiteindelijk omarmt,uit eigen belang.Blockchain overigens is niet hetzelfde als een cryptomunt.Een dollar biljet is ook niet hetzelfde als zijn waarde en hoeveelheid in goud.Alles draait om vertrouwen , en cryptomunten zijn het vertrouwen in de blockchain, gratis is het niet, wel oneindig veel goedkoper.Over 10 jaar is een blockchain platform net zo normaal als een internet site.Ik weet bijna zeker dat China dit doet om een peace of the cake te pakken , maar dat gaat niet lukken , zie mijn bovenste reactie.fiat wordt niet waardeloos, het krijgt een andere naam op een USB stick, niet meer in een safe op een malafide bank.

Er wordt vooral gevreesd voor de val van fiat geld en daarom wordt bitcoin zwart gemaakt en de blockchain geprezen. Het kan geen kwaad om wat crypto te hebben als je wat kan missen. Wegzetten (hardware wallet) en dan over een paar jaar eens kijken wat het waard is. https://goo.gl/4YkhAz